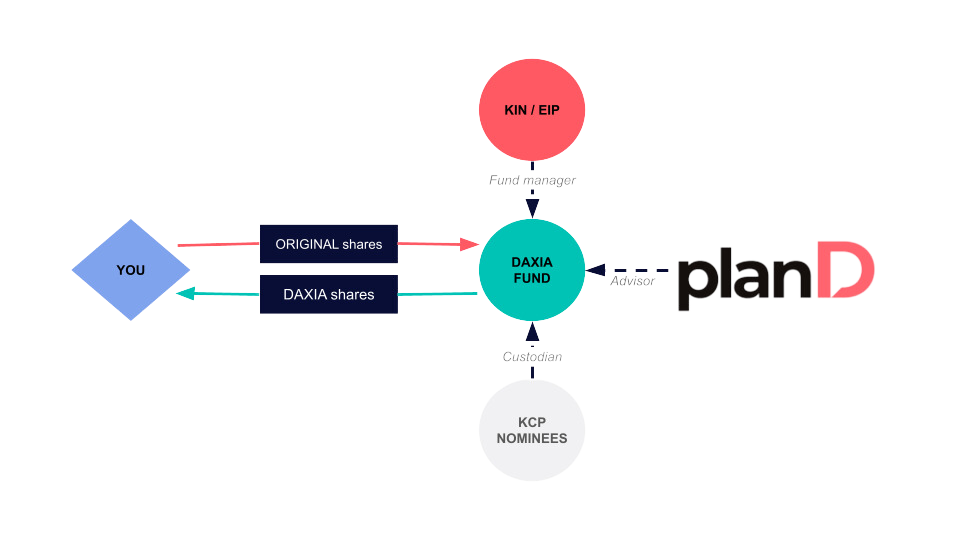

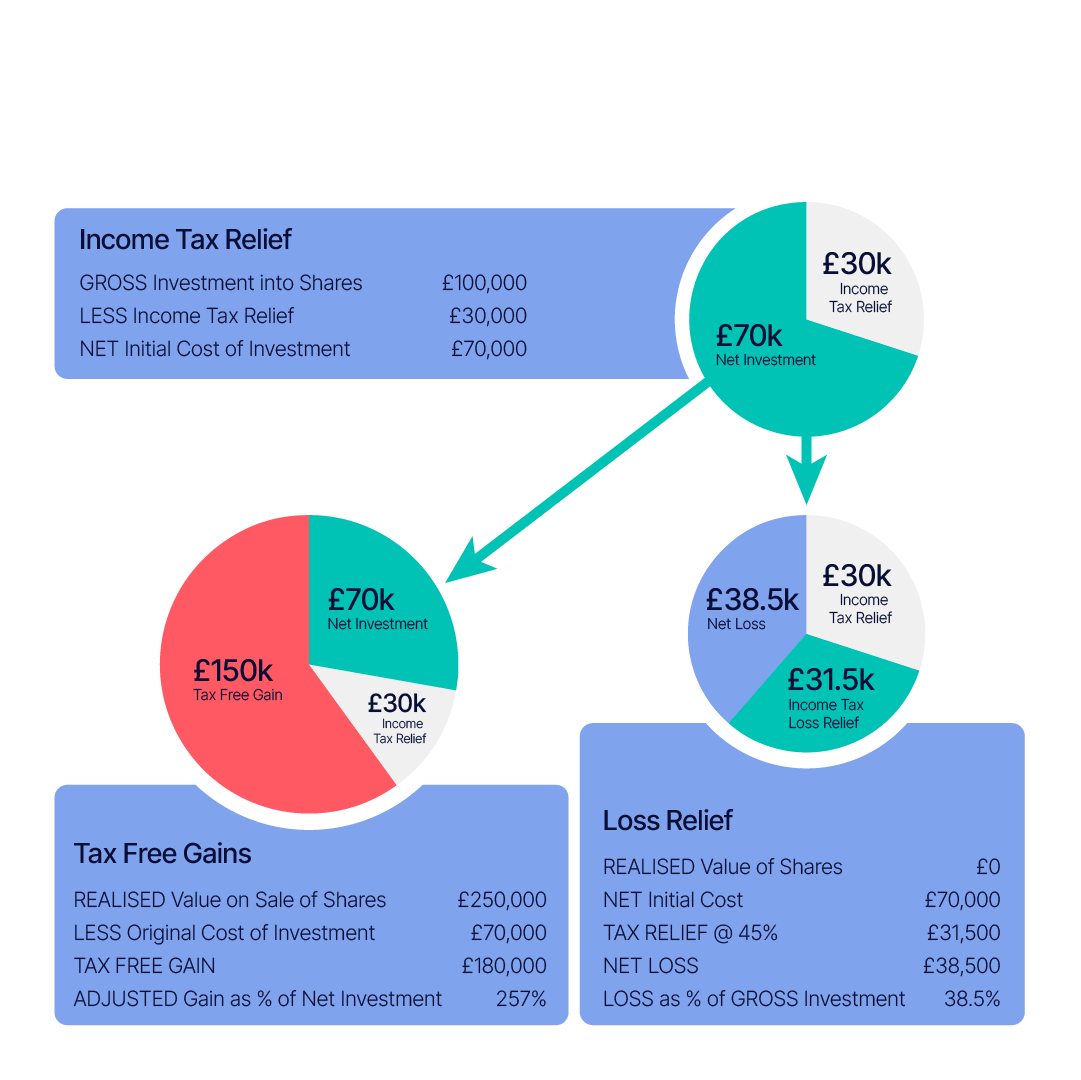

I use planD strategically. Years I have gains that I need to offset, I use their Share Exchange to exit stale investments, creating the tax offset I need and still letting me partake in any upside that may unexpectedly happen. With planD for the first time ever, an early investor can plan when to take a loss, creating a more favourable tax structure and making startup investing just a little bit easier