We've designed our suite of products to help investors and founders take positive action on underperforming assets and plan for the future.

Details on our Share Exchange transaction and how that helps Investors

Your New planD: Exchange Your Underperforming Shares

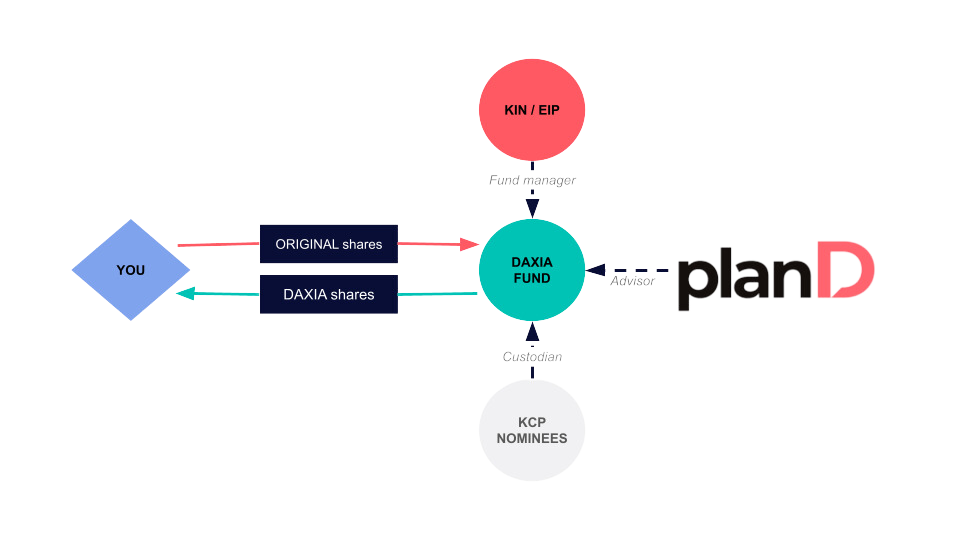

Daxia is a unique fund focused on acquiring stakes on a share exchange basis (no cash) in underperforming companies, providing investors an exit via diversification™ and exposure to a varied portfolio that has improved chances of a better performance in the future.

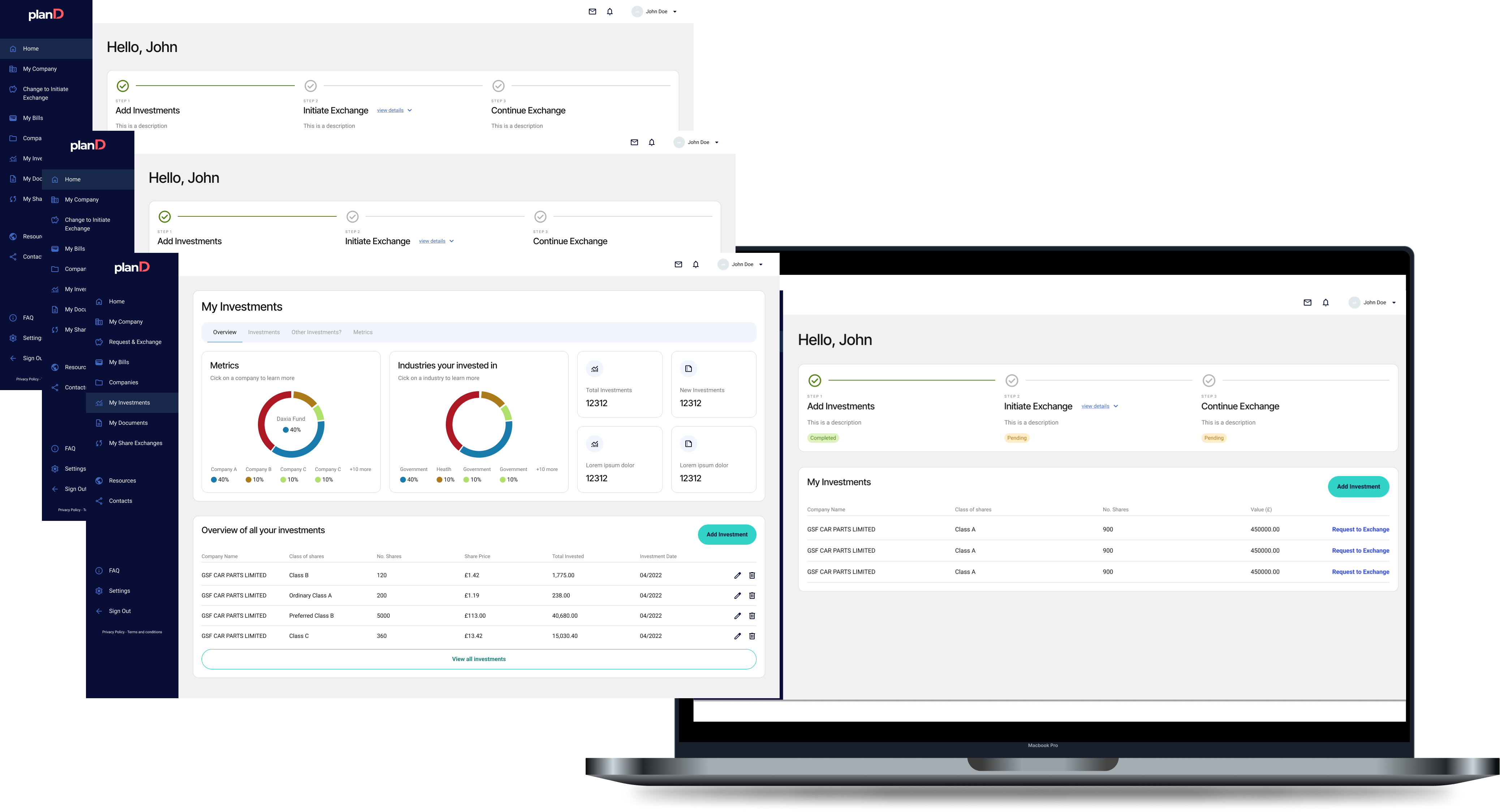

Our platform delivers a seamless process for founders from due diligence and fair market valuation to offering the transaction to investors who self-serve until the exchange is completed. All the corresponding documents can then be accessed via the planD platform to which all involved parties gain free access.

A Platform Built For You

Our clients use our platform to network with other sophisticated investors to discover their next opportunity.

Investor-Focused

Expert Advice

Private Investment Management

Share Exchange Calculator

See how we bring new value to your underperforming assets using a share exchange to the Daxia Diversified Fund.

Pricing

Risks

Whilst your investment into the Daxia Fund will not be for a cash consideration, but be a share for share exchange, this is still considered by the FCA to be a high risk investment and thus you should be aware of the risks associated with high risk investments in unquoted companies. A summary of the main risks can be found here.